tax loss harvesting wash sale

The proposed ordinance would impose an additional tax as follows. But you need to familiarize yourself with the wash sale rule which.

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Assuming that there are current capital gains to offset that.

. With tax-efficiency at the core Morningstar Direct Indexing aims to. A wash sale is one of the. The City collects a tax on the sale or transfer of property.

This means so long as the. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. At my ordinary income marginal tax rate I saved 2192 on my taxes the 9135 loss multiplied by my ordinary income marginal tax rate of 24.

That is the investor cannot sell an asset at a loss and buy a substantially. Loss harvesting is something to be done in taxable accounts as there are no losses to be harvested in tax-deferred accounts such as IRAs. Tax alpha is the result of increasing after-tax returns for investors through implementing a tax-loss harvesting strategy.

In order to make use of tax-loss harvesting the investor cannot violate the IRS wash sale rule. Tax-loss harvesting may now be more attractive with the SP 500 Index down by. 2 days agoBut if you sell SPTL at a loss and buy VGLT theres a good chance that it will trigger a wash sale and your tax loss harvest will be disallowed.

The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting. That type of mismatched tax treatment. Harvesting generates a 5000 capital loss.

However the IRAs do come into. Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction. A 4 percent tax on the sale and transfer of real.

These losses can help offset capital gains. Once losses exceed gains you can subtract up to 3000 per year from regular income. Stated simply tax-loss harvesting means selling an investment that has lost value and purchasing another security to replace it.

The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax benefit. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. Instead the disallowed loss increases the tax basis of the substantially identical securities.

Investors looking to write off any capital losses need to beware of wash sales which can derail their attempt to claim a deduction during tax time. 800 767-8040 Free Consultations Nationwide. Tax-loss harvesting or tax-loss selling is the process of realizing capital losses by selling securities that have underperformed at a net loss.

An investment was originally purchased for 20000 but is now down 25 to 15000. Then the investment loss can potentially be used to.

Tax Loss Harvesting With Fidelity A Step By Step Guide Physician On Fire

Tax Loss Harvesting Flowchart Bogleheads Org

Us Tax Law And Cryptocurrency Part 2 Tax Loss Harvesting And Wash Sales R Cryptocurrency

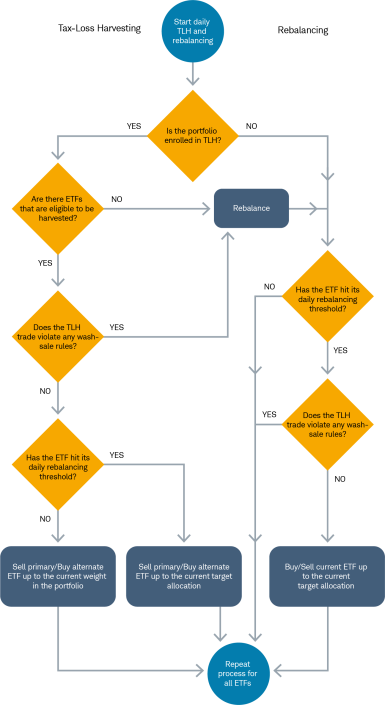

Rebalancing And Tax Loss Harvesting In Schwab Intelligent Portfolios Charles Schwab

Tax Loss Harvesting Napkin Finance

Top 5 Tax Loss Harvesting Tips Physician On Fire

Wash Sale Rule How To Keep Your Tax Loss Claims Clean Forbes Advisor

What You Need To Know About Tax Loss Harvesting And Wash Sales Son Of A Doctor

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Tax Loss Harvesting Is A Strategy Used By Investors To Reduce Their Tax Burden By Taking Losses On One In Investing Chart Investment Financial Literacy Lessons

What Is Tax Loss Harvesting Truist Invest

Wash Sale Rule What Is It Examples And Penalties

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting Is Easier With Etfs But Beware The Wash Sale Rule Thinkadvisor

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Tax Loss Harvesting How To Make The Most Out Of Market Volatility Warren Street Wealth Advisors