are political contributions tax deductible for corporations

If youre wondering if campaign contributions are tax deductible for your business the same rules apply. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to.

The Price Of Zero Public Citizen

116-25 Section 3101 requires electronic filing by exempt organizations in tax years.

. There are five types of deductions for. Donations to this entity are not tax deductible though. The Taxpayer First Act Pub.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. Political contributions are not tax deductible though. You can only claim deductions for contributions made to qualifying organizations.

The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations. A campaign statement must be filed with a deadline by which. A corporation may deduct qualified contributions of up to 25 percent of its.

Businesses cannot deduct contributions they make to political candidates and parties or expenses related to. Table of Contents. A corporation may deduct qualified contributions of up to 25 percent.

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to. You cannot claim political deductions on your tax return for. Business OwnerSelf Employed Tax.

Political contributions arent tax deductible. A lot of people assume that political contributions are tax deductible like some other donations. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations.

Political Contributions and Expenses Paid. Political donations are considered charitable donations contributed by some people. However there are differences from other philanthropic contributions which are tax deductible.

A tax deduction allows a person to reduce their income as a result of certain expenses. The simple answer to whether or not political donations are tax deductible is no. What contributions are tax deductible.

Required electronic filing by tax-exempt political organizations. You cant make a tax-deductible donation to a candidate or campaign but you can make a deductible contribution to a 501 c 3 organization that can lobby candidates about issues. Are Political Donations Tax Deductible.

Are Political Contributions Tax Deductible for Businesses.

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Solved 27 000 Question 53 Which Of The Following Statements Chegg Com

Are Political Contributions Tax Deductible H R Block

Are Political Donations Tax Deductible Paystubcreator

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Are Political Contributions Tax Deductible H R Block

Free Political Campaign Donation Receipt Word Pdf Eforms

Are Political Contributions Tax Deductible Tax Breaks Explained

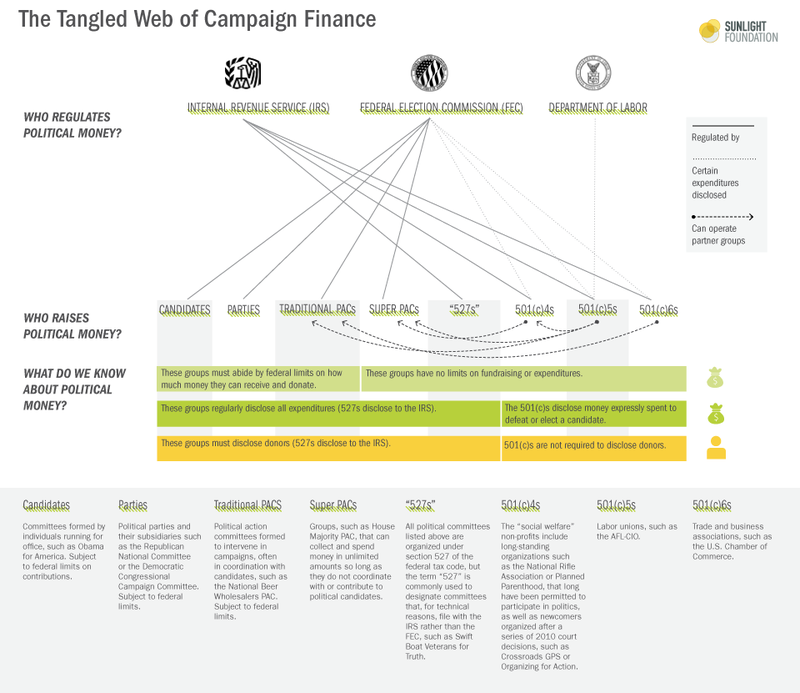

Campaign Finance In The United States Wikipedia

Why Political Contributions Are Not Tax Deductible

Federal Political Financing In Canada Wikipedia

Sunday Happy Hour With The Hullinghortsts Jonathan Singer

Are Political Contributions Tax Deductible Smartasset